Estimating National production based on Output flow, is named output approach.

When calculating national accounts with output approach, multiple counting can occur.

To avoid multiple counting, two methods can be used.

- Final product method.

- Value added method.

- Final product method includes only the final values of consumer goods , Investment

goods and services.

- The total of value added of all sectors as agriculture, industry and services is termed

Gross Domestic Production.

- Value added can be calculated with the difference between total value and inputs.

- Value added is explained as all new values which are added to the production process

at different times.

- It includes, the payments for factor services, net indirect taxes and depreciation

Income is generated through the production process and that income will be spent to purchase goods and services.

The components of aggregate expenditure are as follows

- Private consumption

- Government consumption expenditure

- Investment expenditure

- Net export

The consumption expenditure depends on the disposable income. C = f (Yd)

Private consumption expenditure comprises

- Buying durable consumer goods

- Buying non durable consumer goods

- Buying services

The expenditure on capital goods is, investment expenditure .Example: Machinery, tools, housing and etc.

Government expenditure spent to purchase goods and services from private sector to provide various economic activities.

Example:

- Provide public goods

- Provide merit goods

- National security

- Government administrative cost

The difference between export revenue and import expenditure is net exports

This net export can be either negative or positive.

The determinants of private consumption can be shown as follows.

- Disposable income

- The wealth of households

- Levy of taxes by the government

- Loans of households

- The determinants of investment expenditure are; as follows Demand for goods produced through new investments.

- Changes of interest rates and corporate taxes.Business expectations

The factors of determining the government consumptions expenditure are as follows

- Usage of public goods

- The expenditure on welfare goods

- The expenditure on public administration

Aggregate income (Y) and aggregate expenditure (E) are equal in macroeconomic equilibrium.

This can be illustrated through two approaches.

- Withdrawers and injection approach

- Income and expenditure approach

- Income and expenditure approach illustrates the equilibrium in a simple economy as,

Aggregate income= Aggregate expenditure Y = E

- In a simple economy the determinants of aggregate expenditure (E) are Private consumption expenditure and investment expenditure

- It can be illustrated with the following equation E= C+I

Aggregate income is utilized for consumption expenditure and savings in a simple economy

It can be illustrated with the following equation. Y = C+S

With withdrawers and injections approach, the equilibrium in a simple economy can be

illustrated as follows

Y = C+S

E = C+I

Y = E

C+S = C+I

S = I

Savings are withdrawers (W) and investments as the injections (J). Therefore with- drawals and injections are equal in the equilibrium.

The consumption function can be illustrated as follows.

C = a+byd C = Consumption

a = autonomous consumption

b = Marginal propensity to consume

y = Disposable income

Autonomous consumption is determinants independent of current income.

Marginal propensity to consume shows the fraction of change income which is

consumed.

It can be calculated as follows

MPC = ΔC/ΔY

b = Marginal propensity to consume (MPC)

Δc = Change in consumption

Δy = Change in income

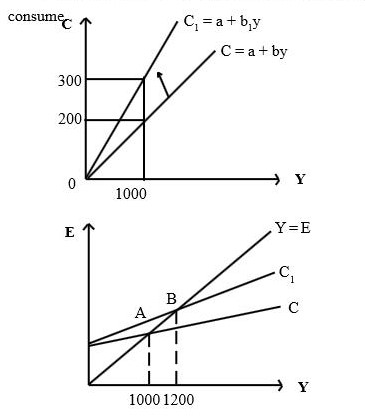

The consumption function can be illustrated with a graph.

![rg4y (2)]()

Saving function also can be illustrated as

S = -a + (1-b) yd

S = Savings

a = autonomous savings

(1-b) = Marginal propensity to save (MPS)

Marginal propensity to save shows that a fraction of change in income which is saved. It can be calculated as

MPS = ΔS/ΔY

ΔS = Change in savings

ΔY = Change in income

MPS = Marginal propensity to save

Saving function also can be illustrated graphically.

![tyr (2)]()

Assuming that though the income is changed, the investment is constant in a simple

economy According it, the investment can be shown as

![hjft (2)]()

Equilibrium in a simple economy can be computed with,

- a schedule

- graphical presentation

- Equations

Equilibrium can be calculated with a schedule in a simple economy

![tyurty (2)]()

The equilibrium of a simple economy can be computed graphically

![u (2)]()

According to the diagram, national Income is illustrated with the point E.

The equilibrium in a simple economy can be calculated with the graph and equations

also.

Change in equilibrium in a simple economy depends on the following components.

- Change in consumption function.

- Change in investment.

Change in consumption function depends on two factors.

- Change in autonomous consumption

- Change in Marginal Propensity to consume (M.P.C)

Change in consumption function can be illustrated with the change in autonomous consumption.

![rt (2)]()

![rt (3)]()

According to the above diagram, the consumption function has changed due to the change in autonomous consumption.

The aggregate expenditure curve has also shifted due to the change in consumption curve.

The equilibrium output level has also changed.

The equilibrium level can be changed with the change in Marginal Propensity t![fdgh (2)]()

- The slope of the consumption curve is changed because of change in marginal propensity to consume.

- Slope of Aggregate expenditure is also changed with the slope of consumption curve.

- The equilibrium level has also changed. In a simple economy, the equilibrium

level has also changed due to change in investment.

![tuy (2)]()

Investment curve is changed due to change in investment.

When investment curve is changed, the expenditure curve also will be changed.

Therefore the equilibrium level of output also will be changed.

Because of the change in autonomous expenditure, the influence to change the output is

explained as the multiplier effect. (K)

The change in the autonomous expenditure of a simple economy, that is the

autonomous consumption and autonomous investment influence the multiplier effect.

Multiplier in a simple economy can be computed as follows.

Multiplier in a simple economy = K

K=1/(1-b)

b= Marginal Propensity to consume

• This can be explained with a simple example. change in autonomous expenditure causes to change the output

This can be illustrated with the multiplier.

Y = (1/(1-b) )X ΔI

ΔY = Change in income

ΔI = Change in autonomous investment

- Change in output is computed with a multiplier when autonomous expenditure is changed.

This is explained with the following example.

Assuming Marginal Propensity to consume is 0.75 when investment (I) is increased

from 50 to 100.

Change in output is ,

ΔY = 1/(1-b) X I

ΔY = (1/ (1-0.75) )X (100-50)

ΔY = 4 x 50

ΔY =200

This can be illustrated with the following diagram

![ghj (2)]()

Multiplier effect can be also explained with a statistical table example.

Equillibrium level of output depends on a level of full employment or outer.

- Various objectives which society wants to fulfill are explained as macro economic

objectives.

- Expected targets to direct macro economic variables are named macro economic

objectives

Macro economic objectives are as follows

- Full employment

- Economic Stability

- Equity

- Economic growth

- Sustainable development

- Full employment means all resources of the economy which are used in maximum

efficiency to produce goods and services.

- Equity means to minimize the unequal distribution of income.

- Equity does not mean equal distribution of income among house holds.

- Earnings can be varied with quality of human resources and productivity but it is not

contradictory with equity.

- Macro economic stability is explained as maintaining the internal and external

stability in the economy.

- Price stability and full employment are important in internal stability.

- To maintain fixed foreign exchange rate and a balance B.O.P is important in external

stability

- The reason for economic growth is increase in real National Production for a period

of time and production possibilities curve will shift to the right in economic growth.

- Standard of living will increase if the increased real income is divided among

people fairly.

- Sustainable development is explained as a balanced development of economic,

social and environmental sectors.

When a closed economy is open to the foreign sector, it is called an open economy.

The components that are used to compute the equilibrium in an open economy are as follows.

- Consumption (C)

- Savings (S)

- Investment (I)

- Government purchases (G)

- Transfers (Tr)

- Autonomous taxes (T)

- Imports (M)

- Exports (X)

Equilibrium in an open economy can be explained through two approaches.

- Income and expenditure approach

- Withdrawals and Injections approach

- According to the income and expenditure method, equilibrium in open economy can be calculated as follows. Y = C+I+G+ (X-M)

- Equilibrium in an open economy also can be calculated using the withdrawals and Injections method.

Withdrawals= S+T+M

Injections = I+G+X

W = J

S+T+M = I+G+X

- Savings (S), autonomous taxes (T) and Imports (M) are considered as withdrawals.

- Investment (I) Government purchases (G) and Exports ( X) are considered as

injections.

- Equilibrium in an open economy can be presented with a statistical table and

graphically.

There are four main economic agents/ sectors that contribute to macro economic activity

• Households

• Business sector / Enterprises

• Government

• Foreign sector

- Macro economic is implemented with the transaction flows of economic sectors.

- These transactions flows can be illustrated with a simple diagram.This diagram is named, circular flows of income and expenditure.

- The economy which is implemented in households and the business sector is treated as a simple economy.

- In this simple economy savings is a withdrawal / leakage and investments is an injection.

- Aggregate income and aggregate expenditure are equal in a simple economy if savings and investments are equal.

- The functions of a simple economy can be illustrated with an income and expenditure flow, as savings that is either no savings and investments or there is savings and investments in the economy.

- The functions of a closed economy with government intervention to a simple economy

can also be illustrated with income and expenditure flow and can be illustrated with

income and expenditure

- In a closed economy, total of savings and taxes are the withdrawals and the total of

government purchases and investments are the injections.

- When taxes and savings are equal to the investments and government purchases, then

the aggregate income and aggregate expenditure are equal. That is Y =E.

- If all four sectors function in the economy it is explained as illustrated by the

following income and expenditure flow.

- Income and expenditure flow of an open economy can be illustrated as follows

![Untitled-1tytr]()

- In an open economy, withdrawals are savings, taxes and imports while

investments, government purchases and exports are the injections

- When all withdrawals and injections are equal in the open economy, then the

aggregate income and expenditure are also equal.

- Income and expenditure flow explains, that production flow is equal to income flow,

and income flow is equal to expenditure flow. ·

- National income accounting estimates the value of production, income and

expenditure flows.

- Some items should be exchanged in national income accounting

The following items should be exchanged from National accounting

- Transactions in the money market.

- Exchanged of intermediate goods

When government intervenes in a simple economy, it is termed a closed economy

Therefore, the aggregate income and expenditure components include Taxes(T), Government purchases(G) and transfers(Tr).

Only autonomous taxes are considered as taxes.

The following components are used to compute the equilibrium in the economy.

- Consumption (C)

- Savings(S)

- Autonomous taxes (T)

- Government Purchases (G)

- Transfers (TR)

- Investment (I)

The equilibrium can be explained with two approaches.

- Income and expenditure method.

- Withdrawals and Injections method.

Aggregate expenditure in a closed economy can be explained as the sum of private consumption expenditure (C) Investment (I) and government purchases.

It can be shown with the following equation.

E = C+I+G

If Y = E

Y = C+I+G

- Aggregate income (Y) in a closed economy equal the sum of expenditure on private

consumption (C) Personal savings (S) and Autonomous taxes (T).

- It can be illustrated with the equation. Y = C+S+T

- Equilibrium in the closed economy can be shown through the withdrawals and injections method as,

E = C+I+G

Y = C+S+T

Y = E

C+I+G = C+S+T

I+G = S+T

- Illustrates (S) Savings and illustrates (T) Autonomous taxes. illustrates (I) Investment and is the (G) Government purchases.

- The consumption function in a closed economy can be illustrated as,

C = a+b (Y-T+TR)

a = Autonomous consumption

b = Marginal Propensity to consume

T =Autonomous taxes

TR = Transfers

The equilibrium in a closed economy can be illustrated in the following ways.

- With a statistical table

- With graphical presentation

- With equations

The equilibrium in a closed economy is calculated based on statistical schedule.

![hrtru (2)]()

The equilibrium in a closed economy can be illustrated graphically.

![gert (2)]()

According to the above diagram point ‘A’ illustrates the equilibrium.

The main variables which decide the economic activities are known as macro economic variables.

Macro economic variables can be shown as follows

• National output

• Employment

• Price level

• Balance of payment

• Foreign exchange rate.

- When the activities of the main economic variables change, the aggregate production

of the economy also changes.

- Business cycles are explained as the cyclical behaviour of real gross domestic

production which changes with time.

- Business cycles can be used to understand the relationship of short term and long

term behaviour of a macro economy.

Can understand the four periods of a business cycles.

• Recession

• Trough

• Expansion

• Peak

This can be illustrated with a graph.

![Untitled-1yu67]()

- The point where the actual output is at its minimum, is trough; and maximum point of

the actual output is peak.

- The period from trough to peak , is the period in which the actual production is expanded.

- The period from peak to trough is the periods in which the actual production is

constructed; and this the recession.

- Time periods of expansion are longer than recession .

- Time from one peak to another peak is the length of a business cycle and these lengths

vary in a business cycle and lengths vary with each other.

- The long term trend of a business cycle can be explained as either economic growth or

economic decline.

Government intervenes, when market equilibrium which is decided by market forces of demand and supply, are unfavourable to society, to introduce control price, which is explained as price control policy.

- Implementing a maximum price legally is termed maximum price ceiling.

- If the maximum price is to be effective it should be lower than equilibrium price.

- Implementing a maximum price ceiling can be illustrated using a following

diagram.

![1]()

The following consequences can result from with maximum price policy.

- Shortage of goods.

- Non price rationing

- Creation of a black market price

- Creation of a economic inefficiencies

The following diagram illustrates a how black market occurs with maximum price policy.

![2]()

C+E = Loss of economic surplus

P2 = Black market price

The following diagram illustrates how economic inefficiencies occur with

maximum price policy

![3]()

Economic surplus before price ceiling A+B+C+D+E+F.

After price ceiling policy consumer surplus is only A. and producers surplus is only F.

After implementing maximum price ceiling policy economic, surplus of C+E is a loss to society.

If consumer does not have to pay an extra amount to purchase scarce goods except A,B and D will be added to consumer surplus.

The following methods can be shown to clarify maximum price.

- Rationing

- Imports

- Incentives for the production.

Non price rationing measures can be illustrated as follows

- Queues

- Use of ration cards

- Rationing with bribes

- Distribution is connected with other goods.

- Goods can be imported as a solution for the shortage created in market as the result of a

price control policy.

- Minimum price is explained as the price which is implemented higher than equilibrium

price to give a better price for producer and factor owners.

- If minimum price is implemented lower than equilibrium price, the objectives of minimum

price policy cannot be obtained.

Minimum price implementation can be illustrated with the following diagram.

![4]()

- The following consequences can occur in the market with minimum price policy.

- Excess supply or surplus of supply.

- Unemployment can occur when minimum price is implemented in the labour market.

- Excess investment situation can occur.

- Goods can be supplied to consumers at discounted rates by keeping minimum price as

nominal price.

Welfare effects of minimum price policy can be illustrated with the following diagram

![5]()

When implementing minimum price consumer surplus, producer surplus will be

changed.

The following steps can be taken to clarify minimum price.

- Hoarding excess supply

- By products

- Promoting demand.

- Exports

Government can implement a price support policy with minimum price to give a higher income to producers

- after implementing minimum price policy, it market supply is limited to Q

2,the welfare loss to society will be B and C

- If the producer decides to expand the market supply up to Q1 after implementing minimum price policy the welfare loss the society cannot be assured.

- If the producer decides to expand market supply to Q1 after implementing minimum price policy and if the government purchases the excess supply the welfare loss to society will be B+C+E+F+G

Subsidies can be implemented on the producer in two ways

- Unit or specific subsidy

- Ad Valorem subsidy

Providing a specific amount on one unit of production is explained as a unit

subsidy.

Taxes can be implemented on producer in two ways

- Specific tax or unit tax.

- Advalorem tax

- Unit tax is a specific rate on a production unit which is sold.

Taxes can be implemented on the producer in two ways

Tax incidence is divided according to the demand and supply elasticity can be explained graphically.

- The consumer bears the total tax incidence in perfect inelastic demand.

- The producer bears the total tax incidence in perfect elastic demand.

- Tax burden is divided equally between the consumer and producer in a unitary

elastic demand.

- Inelastic demand more tax burden should be borne by the consumer, and the producer bears less tax burden.

- Inelastic demand more tax burden should be borne by the producer, and the consumer bears less tax burden.

- The producer bears total tax incidence in perfect inelastic supply.

- The consumer bears total tax incidence in perfect elastic supply.

- Tax incidence is divided equally between consumer and producer in unity elastic

demand.

- The producer has to bear more tax incidence in inelastic supply.

- The consumer has to bear more tax incidence in elastic supply.